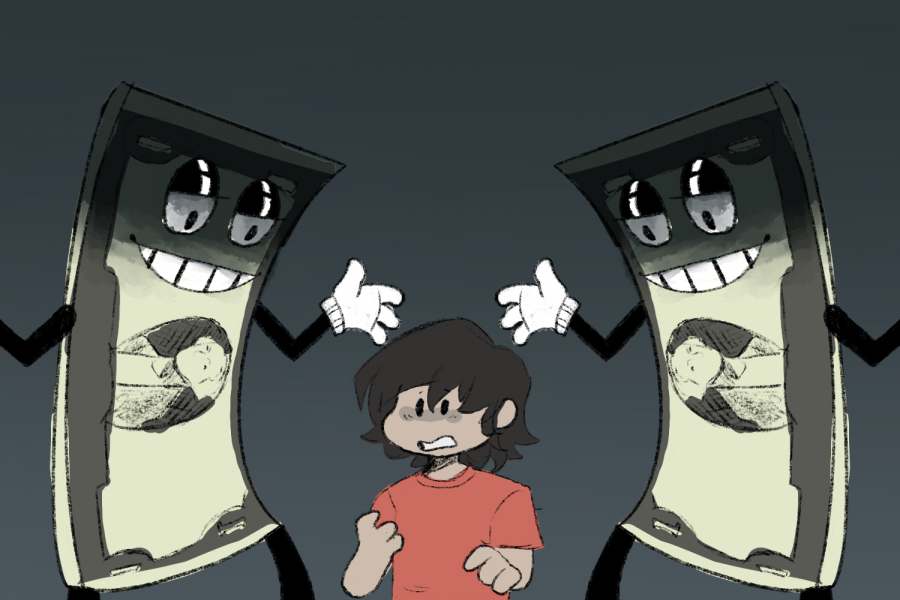

A price to pay

Lack of financial education classes leaves students unprepared

April 14, 2021

When Capital One asked a thousand adults about the most significant stressors in their lives, 77% of adults cited their worries with money as the challenge that stands out above all else. Since there’s always bills to pay, a determination to make enough to scrape by often occupies one’s mind before all else. But it’s not as simple as getting a job and working hard; it’s smart money management that separates those who live free from financial stress and those who don’t.

But how does one obtain these skills? A good credit score doesn’t fall into one’s lap, neither does a knowledge of how to invest. It’s education that will get people to proficiency with money, and unfortunately, schools are decidedly lacking in this area.

Texas High School, along with the vast majority of high schools across the country, could improve when it comes to preparing students for all things finances. No one is forced to make investments or build good credit; but things like paying taxes and budgeting aren’t optional. However, high school students are not prepared for any of these challenges.

In order to fulfill education’s promise of preparing students in all aspects, schools must make a conscious effort to push classes and programs that prepare students for a world where living well has a price tag.

First, not everyone has the kind of parents who will sit down and help their children learn how to spend and save. Those privileged enough to have these kinds of mentors around them often forget how lucky they are. The Charles Schwab Corporation found that the majority of parents consider learning about budgeting and credit card management to be more important for today’s teens than when they themselves were young. However, far fewer claim to have taught their children these two basic skills (49% and 29%, respectively). It’s especially important, should our goal be ending wealth inequality, to address the discrepancy between who gets taught the necessities. Running these educational courses out of public schools would most indiscriminately make them available.

In addition, current forms of financial education in schools, when they do exist, are rarely taken or even advertised to students. This is seen not only in the inexperience of graduates when dealing with student loans, saving and more, but also in the very words of this unprepared generation. When the Financial Educators Council interviewed 1,101 young adults on “What high school course would have benefited your life the most?”, 51% responded that money management would have served them well.

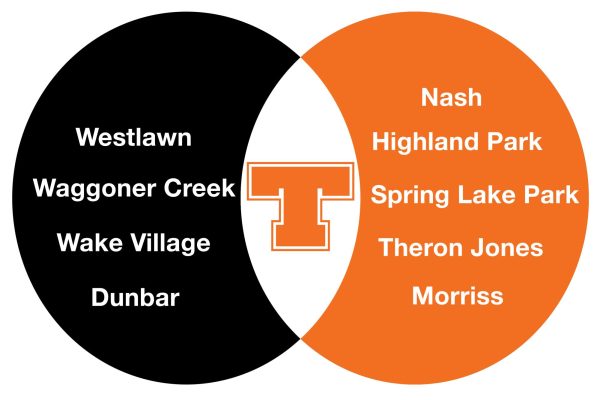

We can see this lack of preparation on a more local level as well. At Texas High, it is intended that every senior be enrolled in a financial literacy enrichment, however, the majority aren’t. It’s not enforced and thus not taken advantage of. In the world of drama, homework and tests, high schoolers will neglect preparation for their financial futures, not realizing their mistake until they are faced with reality.

In order to break young people’s stigmas of finance that the stock market is an old man’s game, that taxes are too complicated to file themselves, and that a good credit score is unachievable, schools must take on the first step by bringing comprehensive financial education to every student (whether they realize its importance or not).